I started seriously saving for a downpayment in 2012. Coincidentally, it was also the same year that I seriously started running (again).

When I say “seriously”, I mean that I ran more than twice a week.

In 2012, I made “run a marathon” and get more aggressive with saving money my goals for that year. At that point, I had no idea that these goals will consume the next three years of my life.

Having only ran a slow 10k and being fresh out of university, I casually said to my friend “Oh, I’m running a marathon in October because I want to qualify for Boston and I also want to buy a house in three years when I’m 25.”

Needless to say, my friend looked at me like I was out to lunch at first, but managed to say a few encouraging words before I set out to accomplish what many others believed were impossible feats for me.

I did exactly what I’ve done before. Working backwards from the goals, I mapped out a plan that would get me to where I wanted to be. I was quite detailed in my plans, leaving no stone unturned. I spoke to a number of people who have successfully accomplished what I wanted to accomplish in order to really learn what it takes.

For running, I planned out the weekly mileage, including how long the long runs will be and what I will eat/drink to recover from the long runs. I also developed a strength training program. Each week, I had a contingency plan, just in case I got injured. Luckily, things went very well during my first marathon training cycle. This is how the race went.

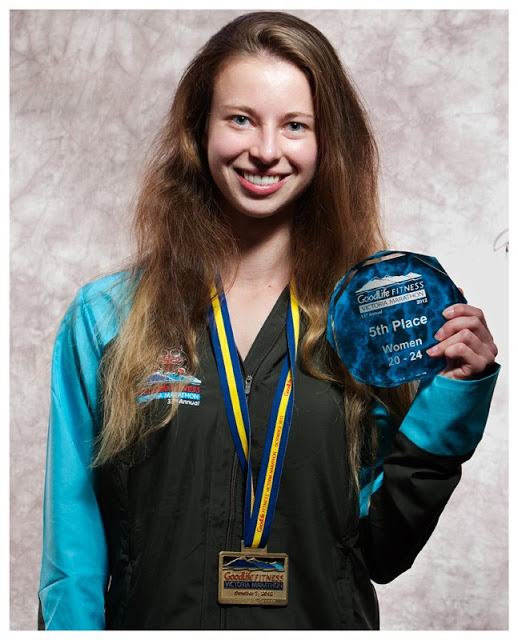

Photo by: Ian Simpson (IMS FotoGrafix)

For saving money, I critically went through all my accounts and credit card statements, analyzing every source of income and every expense.

In 2012 as well as some of 2013 and 2014, my sources of income were: my contracts with the Federal Government, personal training, attending trade shows/promotional events, collecting refundable bottles and cleaning. You better believe I was super busy and yet somehow, I managed to never miss a workout, unless I was so tired or so sick that I could only manage to find enough energy to make it to my bed.

When I looked closely at my expenses, I realized that there are a few things that I don’t need to spend money on anymore. Therefore, the daily trips to Starbucks, shopping for clothes and subscriptions that I no longer took advantage of had to go. Confession time: I didn’t realize that my daily trips to Starbucks were costing me almost $10 a day.

Finishing my first marathon and qualifying for Boston on my first attempt, gave me the confidence to keep moving forward towards my goals. Crossing the finish line of my first marathon made me feel unstoppable. Unfortunately, registering for the Boston Marathon was not in the cards for me (for budgeting purposes). So, I set that aside until later.

By the time the end of 2012 rolled around, I had cut out time and money wasters from my life. I was working and running so much, that I honestly didn’t have the time for time wasters. Then, to save gas, I started running to work. I was killing two birds with one stone working on two huge goals simultaneously.

Shockingly, what ended up happening is that after my long hard runs on the weekends, I was way too tired to go shopping at the mall. Not only that, but I was also way too tired to go out to the bars, which also helped me save money.

The average 20-something spends about $50-$75 per night out (including drinks, cab rides, dinner, tips). Given that each month has about 4 weekends, if you go out Friday and Saturday night, you would end up spending between $400-$600 a month on entertainment.

Since my long runs were on Saturday mornings, I couldn’t go out on Fridays because I could not be hung over and dehydrated for my long run. Then, I also couldn’t go out on Saturday nights because Saturday morning’s long run completely wore me out. Looking back, I believe I ran my long runs a bit too hard.

Then, when Sunday rolled around, I was busy getting organized for the week so I could fit in all my running around all my jobs. During the week, I was so busy that I would wake up on a Monday and realize it was Friday again. While some of my friends complained on social media about being bored, all I could think of “I don’t remember when I was bored last time.”

In the spring of 2013, I ran my 2nd marathon. It didn’t go over as well as I had hoped because I started too fast and did a fitness competition only a few weeks before the race, which required completely different kind of training. So, I did what every runner does after finishing a marathon-signed up for another one in the fall. I figured that would give me enough time to recover and try again.

Day in and day out, I worked and ran.

Run. Work. Save Money. Sleep (sometimes). Repeat. Document the journey.

The 2013 Goodlife Fitness Victoria Marathon ended up going very well,which inspired me to give Vancouver another go in the spring of 2014.

My 4th marathon, the BMO Vancouver Marathon 2014, was another personal best. At that point, I was feeling unstoppable. Strangely, after each marathon, I would go back and forth between “never again” and “I wish I could do this every week.” Ultimately, though, I would just get back to work and try again. I was running personal bests but I still yearned for more accomplishments.

Finally, midway through 2014, I realized that I was, in fact, able to afford to run the Boston Marathon and I was well on track towards reaching my downpayment goals. Therefore, when September rolled around, I registered for Boston 2015 and bought my plane tickets. I was also signed up for the Victoria marathon and my goal was simple: to get a better starting position in Boston and that’s exactly what I accomplished that day. My 3:18:xx was enough for me to move up to a better starting position.

In order to run a marathon under 3:20, I really had to work for it during the training cycle. When I wasn’t running hard, I was working at my multiple jobs. When I wasn’t working, or running, I was reading inspirational books and recovering. I realized, that I didn’t have time to spend money, even when I wanted to.

The Boston Marathon experience was very special to me because it took a lot of dedication to training and budgeting for me to be able to go. I didn’t get a personal best in Boston because there were a lot of things going on during that training cycle. I was sick with the flu that didn’t seem to go away during that winter and we had a nightmare for a landlord, which was stressing me out.

This beauty…is amazing!

The Boston Marathon was one of those things that I’ve been wanting to do since I was 15, but only got to do 10 years later. To this day, I am still grateful for that opportunity, regardless of the fact that it took 10 years to get there.

Once I got back from the Boston Marathon 2015, it was time to focus on a really important goal that I set for myself 3 years ago, which is to buy a house.

You see, part of the reason why my Boston Marathon training didn’t go as well as I was hoping was because I was sometimes unfocused. I was unfocused because we had a terrible landlord who would arbitrarily raise the rent without giving us written notice of any kind, never do any maintenance on the property and would belittle us in any way he could. Therefore, you can definitely understand why it was my goal to buy a place. I remember he offered us a “rent to own” deal, which, after I carefully analyzed it, would end up with us losing over $50,000 and not getting the house (no, I’m not kidding). Luckily, I actually read things very carefully before I sign them, so he didn’t get to take us for $50,000. The place we were renting also had an underground leak, which caused our water bill to skyrocket.

Of course, when I refused to sign his “fantastic rent-to-own proposal”, he made it his goal to make the remainder of our stay at his property absolutely miserable. He even went as far as to find out our possession date and then tried to evict us for non-payment of rent two months before possession date. The funny thing is that prior to his attempt to evict us, we actually tried to pay him and he refused our rent payments. His goal was simple: to make us homeless for two months and to create additional expenses for us prior to possession date. He was very very upset that we didn’t go for his rent-to-own deal. Luckily, the Residential Tenancy Board ruled in our favour and we were able to stay at his place until our possession date and we STILL paid him the rent.

Thankfully, we found a place to buy which didn’t cost an arm and a leg. I felt so proud of myself for being able to save that downpayment in three years through denying myself frequent outings to restaurants, finding alternative means of transportation, working more than one job, and not buying new clothes.

The house was in a perfect location and the offer was accepted a little over 2 weeks after I got back from Boston. Since my mom had to cosign (this is Victoria, after all, and real estate is not cheap), the deal almost fell through due to a Canada Post error which resulted in the paperwork nearly getting lost in transit. Thankfully, the deal went through as planned and we were into the new house and away from the nightmare landlord. Looking back at this now, it’s a very entertaining story.

Between 2012-2015, I experienced a lot of growth. Learning how to stay disciplined with money, time and fitness has been a transformational experience for me. It took me a while to be able to share this story, but I feel that it needs to be shared. I’d be lying if I said that I never felt like quitting. Of course, I had moments of “why am I doing this to myself?” Then, I always went back to that fateful day in early 2012 which set me on that path.

Every time a goal is reached, you are at the start of a new one. Photo by: Heath Moffatt. Gear: Public Myth leggings, Adidas sports bra, Saucony running shoes.

I wrote this for everyone who has been told that they can’t do something, who has dealt with financial setbacks and shady characters along the way, who has had a nightmare for a landlord, who struggles to get their workouts in, who works hard day in and day out, and who has gotten up one more time after falling down.

So proud of you and ALL your accomplishments. By 25! Wow. Wtg Yana. You deserve every single nail biting mortgage, career, running outfit, Starbucks coffee, and PR you set for yourself, I’ll always be your biggest fan. And life only gets better and better. All my love and encouragement, keep up the amazing work, Nancy 😊

Appreciate this post. Will try it out.

This excellent website really has all of the information and facts I needed

concerning this subject and didn’t know who to ask.

Read your blog before getting ready for work this morning, thanks for sharing and it’s inspiring!! Hope all the best for you!!!